Cognitive abilities,self-efficacy,and financial behavior |

| |

| Affiliation: | Finance Department, Fowler College of Business, San Diego State University, 5500 Campanile Drive, SSE 3306, San Diego, CA 92182-8236, United States |

| |

| Abstract: |

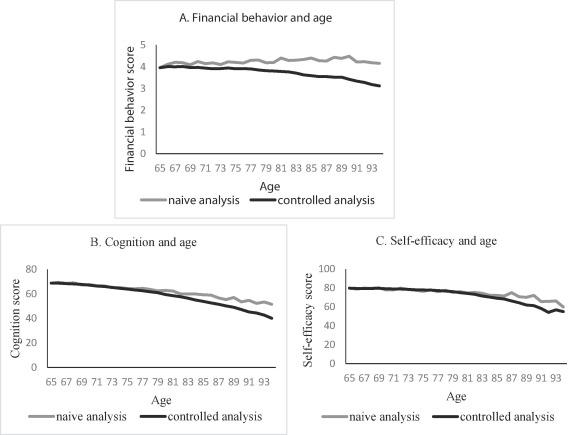

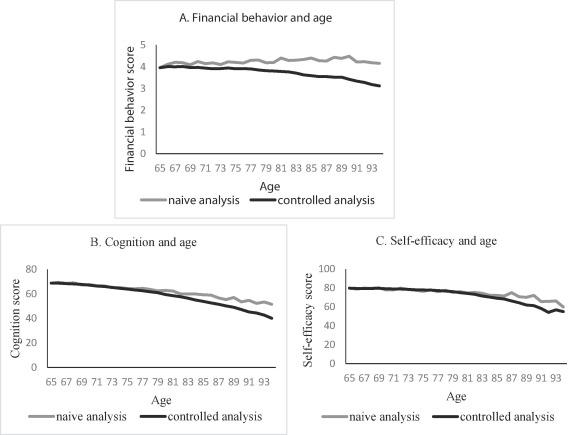

This paper investigates the effect of cognitive abilities on financial behavior among older adults. Using the U.S. Health and Retirement Study, I find that cognitive abilities significantly affect financial behavior through two channels: ability and self-efficacy. People with higher cognition scores achieve better financial outcomes. This positive association is especially strong in tasks having high demand of cognitive abilities, which confirms the ability channel of the cognitive ability effect. In addition, there is evidence for the self-efficacy channel as a secondary source of cognitive influence. Lower cognitive abilities decrease people’s sense of self-efficacy, which, in turn, significantly decreases financial management efficiency. The findings have important policy implications, specifically that more effort is needed to assist the growing older population through the cognitive aging process and that noncognitive skills, as a secondary source of influence, also warrant attention. |

| |

| Keywords: | Cognition Self-efficacy Personal finance Older population D14 D91 G41 G51 3120 3920 |

| 本文献已被 ScienceDirect 等数据库收录! |

|